The largest sectoral rally of 2025 isn’t happening in artificial intelligence—it’s in metals. While investors chase AI narratives, a quieter yet far more substantial rally has been unfolding largely unnoticed by most. These are companies that produce, transform, and distribute the molecules that are the building blocks of virtually every aspect of our lives: metals.

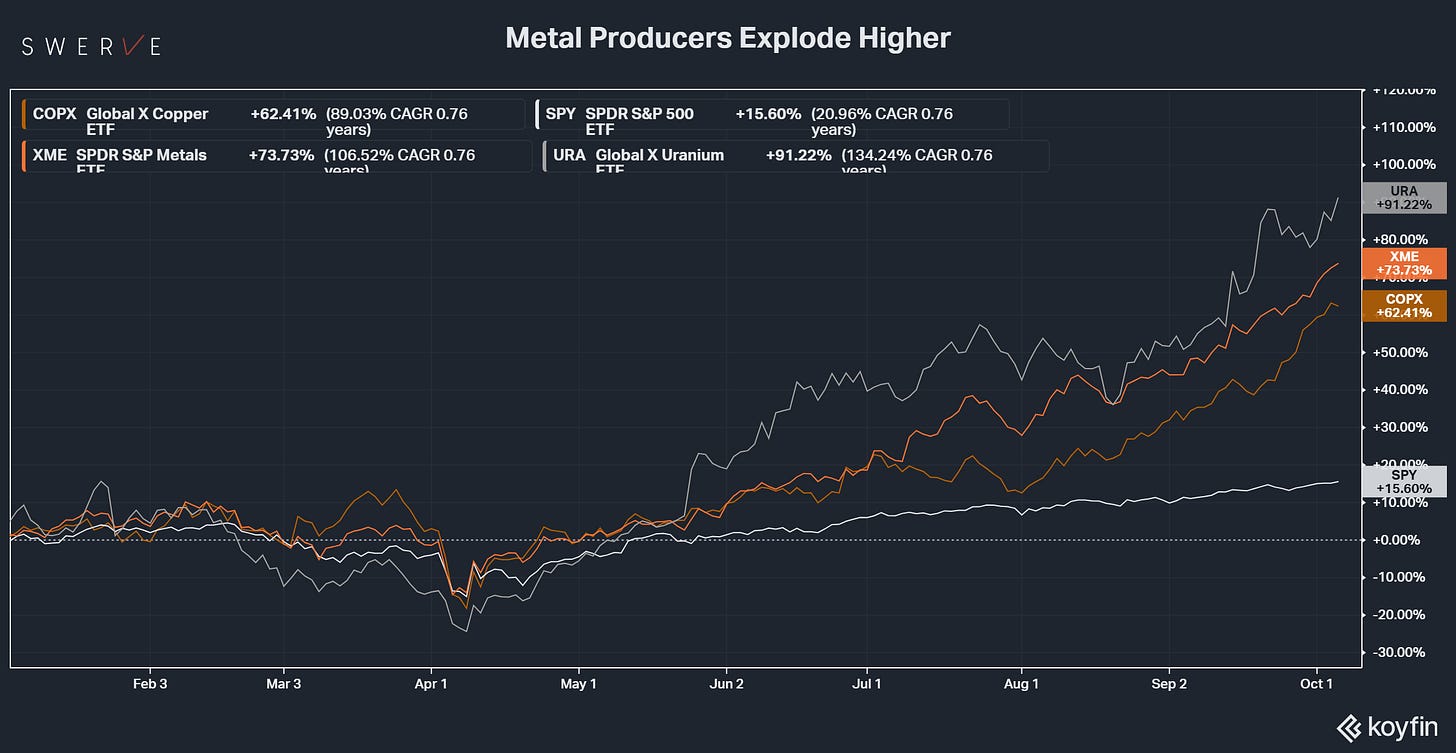

Metal producers have been on a steady uptrend for years, but more recently the price action has significantly accelerated, with some sectors going positively “vertical”:

Copper miners: +62% YTD

Metal producers: +74% YTD

Uranium: +91% YTD

The year-to-date performance of these sectors is outperforming not only the broader markets but also semiconductors and other AI-focused ETFs.

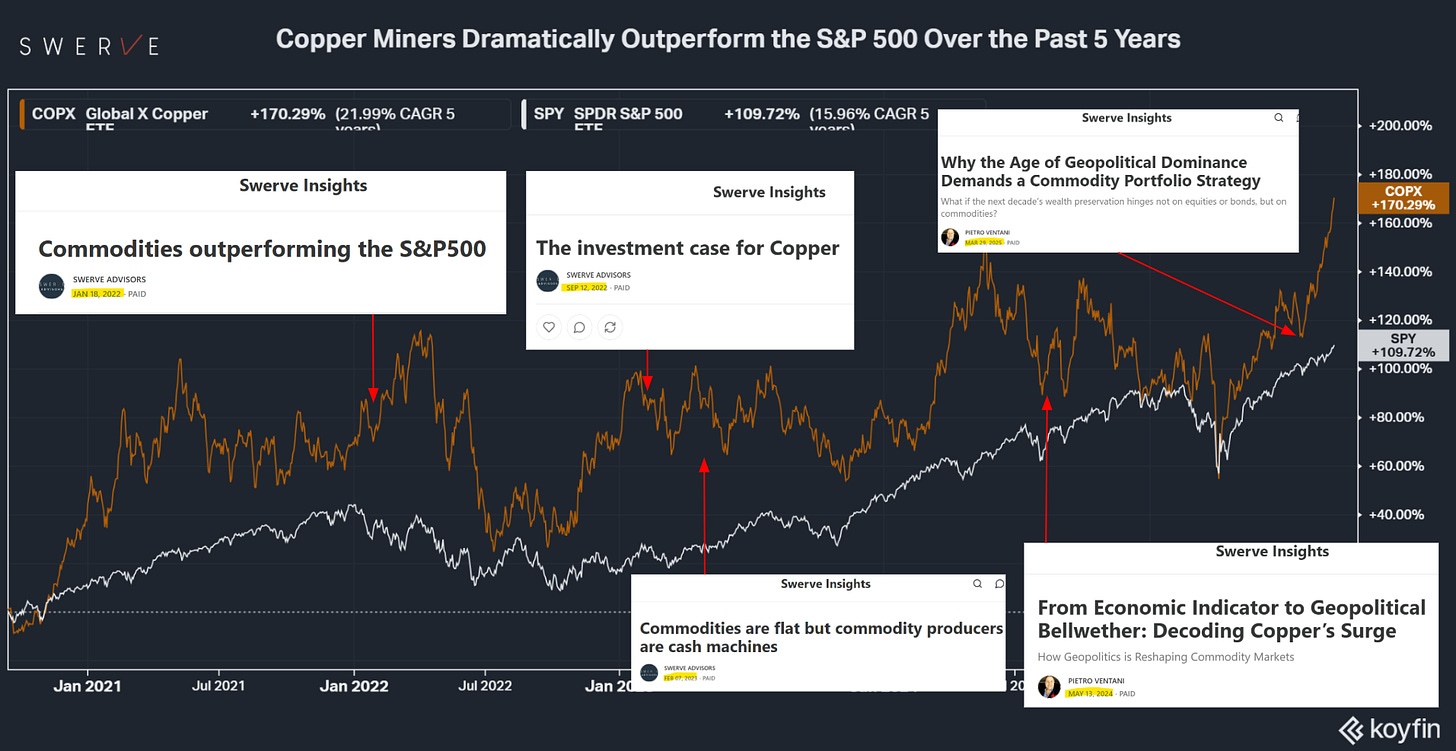

We have been structurally bullish on this sector for years , and our conviction has paid off. XME and COPX, two of the largest sector ETFs, for example, have returned 34% and 27% annualized over the last five years and massively outperformed the broader index.

As commodities are known for boom-and-bust cycles, it is only fair to wonder where we are in the cycle and, more importantly, is there still an opportunity for long-term, risk-cognizant investors?

The Triple Catalyst Framework

What makes this sector so compelling is the convergence of three powerful, largely independent forces all contributing to push prices higher.

Supply-Demand Dynamics and Market Mispricing

The investment thesis for strategic metals is a combination of “old” and “new” economy drivers. All key sectors to global economic growth are predicated on much higher electricity generation capacity, which in turn drives demand for metals. We are not only talking about data centers or EVs but also more basic needs—for example, air conditioning, especially in developing economies. While in the US or Japan, 90% of households have air conditioning, the number for countries like India and Nigeria is 20% and 5%, respectively. Increase in temperatures and higher income are driving penetration of air conditioners, creating unprecedented pressure on those countries’ to build up their electricity generation infrastructure and, in turn creating structural demand for metals.

Valuations further strengthen the investment case. On a trailing basis, mining sector valuations stand at roughly 22× earnings—well below the broader market’s 31× multiple. Equally striking is that the sector’s combined market capitalization amounts to only $324 billion, or about 0.5% of the total US equity market. By contrast, the ten largest companies alone account for nearly 40%.

The question we raised last year remains more relevant than ever: is such a microscopic weighting remotely justified given the sector’s systemic importance—especially when the trillion-dollar tech giants that dominate today’s indices literally depend on these materials to function and grow?

The Deglobalization Premium

The second major tailwind for the sector has been deglobalization. It’s no coincidence that this year’s sharp acceleration began after the April 2 tariff announcement—an event that signaled a decisive turning point in the decades-long trend of global economic integration.

Already in 2023, when consensus for an impending recession led to bearish calls on the sector, we opined that transitional periods, like the one we are currently experiencing, are shaped more by state decisions than by market forces. Hence, strategic materials prices are no longer simply a function of GDP growth. Conversely, we argued, the combination of “the four Ds”—debt, deglobalization, demography, and decarbonization—were going to be key drivers for the sector.

Deglobalization is inherently inflationary for materials as economic nationalism fuels the reshoring of infrastructure and supply chains, while demand from emerging economies continues to rise. Economic nationalism is also a major supply disruptor. We are seeing increasing examples not just in emerging economies such as Indonesia but also advanced ones such as China and the US. That is why back in March we reiterated “Why the Age of Geopolitical Dominance Demands a Commodity Portfolio Strategy”

Monetary Instability: Historical Patterns Repeating

The third and possibly even more consequential cause for metals is monetary. The dollar has been under pressure and that naturally buoys commodity prices. Yet the issue at play may be far larger than inflation. The role of the dollar as a reserve asset in increasingly in question, a trend that is eloquently demonstrated by gold +50% rally this year.

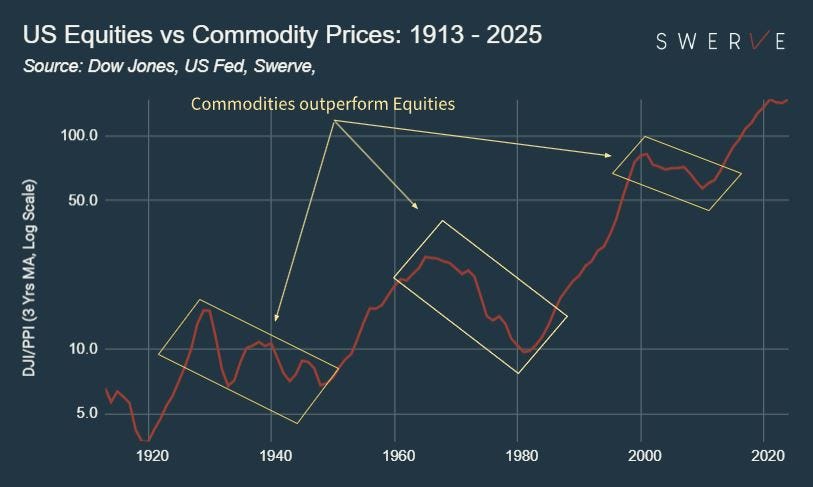

We have long argued that some form of monetary reset may lie ahead—a typical catharsis in the late stages of the debt cycle. Even without assuming such a structural shift, periods of monetary instability have historically coincided with rising commodity prices. A long-term view of equity-to-commodity price ratios from 1913 to 2024 vividly illustrates this pattern.

Over time, equities tend to outperform commodities—a reflection of human ingenuity and increasing productivity, which is about creating more value with fewer inputs, including commodities. However, there have been three distinct periods where this trend reversed and commodities outperformed equities: 1929–1948, 1965–1981, and 2001–2011. Each of these phases coincided with major monetary dislocations.

Timing the Opportunity: Early Innings or Final Act?

The rally in metal producers this year has been extraordinary, and some retracement may be in order. Yet the long-term uptrend should continue as a combination of fundamentals, geopolitics, and monetary tailwinds continues to be very favorable. The likelihood of monetary dislocation is especially supportive of the thesis; currency devaluation and debt debasement do not bode well for traditional investment cycles, hence buoying the price of scarce, inelastic-demand assets.

Investors should therefore reassess their exposure to commodity producers but, as always, the devil is in the details. The sector is vast, the instruments varied, and volatility remains high. Most important is the macro thesis underpinning the investment case.

Take the copper producers ETF, for instance. It has gained 170% over the last five years but also saw drawdowns of 35–40%. The ETF has recently made an all-time high and appears to be breaking out of its uptrend channel.

Investment Implications of a Changing World Order

We have been highlighting the opportunity in commodities since our prescient May 2020 structural inflation thesis. It has been a strong call—It has been a strong call—but if monetary dislocation lies ahead, the bulk of the move may still be in front of us.

The AI narrative has been dominating the investment discourse. Yet doubts about valuations and sustainability are starting to emerge. At times of heightened uncertainty, diversification into sectors that are supported by multiple, uncorrelated—or, better, inversely correlated—investment theses is optimal. Metals producers are one such sector.

In this Age of Geopolitical Dominance, the old playbooks are no longer sufficient. For sophisticated investors, the question isn’t whether this rally will continue—it’s whether current positioning reflects the sector’s strategic importance. In an environment where trillion-dollar tech giants depend entirely on these materials, a 0.5% market weighting is bound to expand.

Disclaimer:

The content of this newsletter is for informational and educational purposes only and does not constitute financial, investment, or other professional advice. The views and opinions expressed are those of the author and are subject to change without notice. While efforts are made to ensure accuracy, no guarantee is given regarding the completeness or reliability of any information, analysis, or opinion contained herein.

Past performance is not indicative of future results. All investments carry risk, including the risk of loss. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions. The author may hold positions in some or all of the assets or securities discussed.